The Social Security System In Germany

What You Have To Know When Starting Your New Work In Germany

If you are starting work as a Physician, Nurse or Midwife in Germany, your employer will register you with the statutory social security providers for health, pension, unemployment, nursing and accident insurance.

You only would need to decide with which of the health insurance companies you would like to register and provide this information to the HR department of your employer - the rest would be done automatically by your new employer.

The benefits of the German statutory social security system are in large parts the same for all insured persons (solidarity principle) and are only partially contribution-dependent (for example certain sickness benefits and the pension one would receive, once retired).

In addition, the German social insurance system also includes prevention and rehabilitation.

‘Sozialversicherung’ - The German Word For ‘Social Security Insurance’

The statutory social security system in Germany includes health insurance, pension insurance, unemployment insurance, nursing insurance and accident insurance.

The Five Pillars Of Social Security In Germany

The German Social Security System rests on the following five pillars:

Health Insurance - ‘Krankenversicherung’

Pension Insurance - ‘Rentenversicherung’

Unemployment Insurance - ‘Arbeitslosenversicherung’

Nursing Care Insurance (e.g. in case of disability) - ‘Pflegeversicherung’

Accident Insurance - ‘Unfallversicherung’

Half of the contributions for the health insurance, pension insurance, unemployment insurance and nursing insurance are covered by the employer - the other half is covered by the employee*.

Somewhat of an exception is the contribution for the accident insurance, as it is always covered in full by the employer.

The table below shows the typical contribution rates as of 1st of January 2021, as percentage from the gross salary.

Please note that the monthly salaries which are subject to contributions are capped.

In other words, if you earn more than the capped amount, you would not have to pay any contributions on the delta.

Overview Social Security Contribution Rates in Germany - 2021:

| Social Security Insurance | Total Contribution | Contribution Employer | Contribution Employee | Monthly Salary Subject To Contributions Capped At |

|---|---|---|---|---|

| Health Insurance | 14% - 16% | 7% - 8% | 7% - 8% | 4.837,50 EUR |

| Pension Insurance | 18.6% | 9.3% | 9.3% | 6700 EUR (East) - 7100 EUR (West) |

| Unemployment Insurance | 2.4% | 1.2% | 1.2% | 6450 EUR (East) - 6900 EUR (West) |

| Nursing Care Insurance* | 3.05% - 3.3% | 1.525% | 1.525% - 1.775% | 4687.50 EUR |

| Accident Insurance | Around 1.3% | Around 1.3% | None |

*There is an exception for the Free State Of Saxony where the employee contributes a somewhat higher percentage for the nursing insurance.

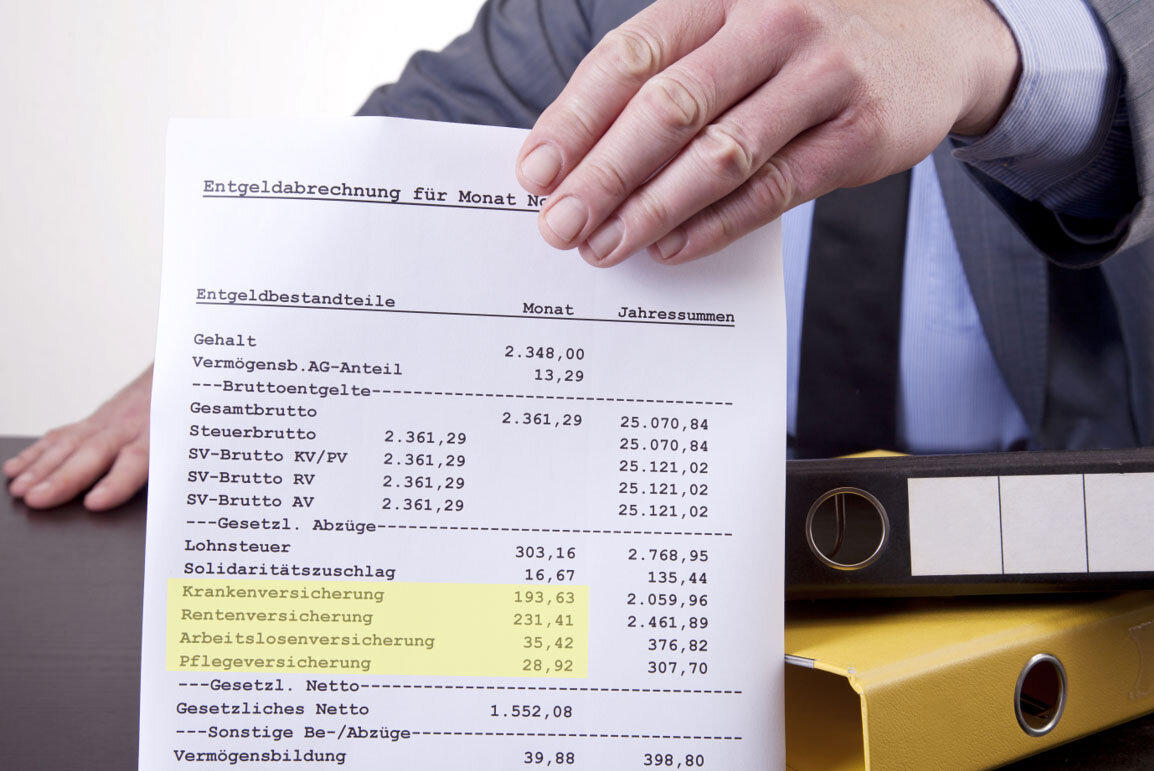

A typical German salary statement with the social security contributions highlighted in yellow.

What Are The Real Life Implications And Benefits?

The German statutory social insurance system is compulsory in order to avoid a preference of persons with low vs. high risks (e.g. healthy vs. sick persons) and to achieve in part a solidarity-based compensation among the insured regardless of the amount of contributions paid.

For example, if you are employed as a Physician, Nurse or Midwife, you automatically enjoy the benefits of health insurance, pension insurance, unemployment insurance, nursing insurance and accident insurance.

You will be protected and supported in case of sickness, need for care, work accidents, work-related diseases, unemployment, maternity and reduced earning capacity. On top of that you will also be entitled to a pension, once you retire.

One big benefit worth mentioning is the fact that spouses and children (often up to the age of 25), who are not employed or do not earn more than 445 Euro per month, are typically co-insured through the working spouse or parent without any additional cost.

What Other Insurances Besides Of The ‘Social Insurances’ Are Typical In Germany?

Well, one thing is for sure, the Germans love insurances… and German insurance companies would love even more to sell you additional insurances. So make sure you make an informed decision before you sign the next best insurance contract for any of the non-mandatory insurances.

You find some of the common insurances below - none of them is mandatory:

Liability insurance - ‘Haftpflichtversicherung’

Legal protection insurance - ‘Rechtsschutzversicherung’

Homeowners insurance - ‘Wohngebäudeversicherung’

Foreign travel health insurance - ‘Auslandsreisekrankenversicherung’

Mandatory if you own a car or motorbike:

Motor vehicle liability insurance - ‘KFZ Haftpflichtversicherung’

Summary

Starting at a new work place in Germany typically entitles you to receive the protection and support of the German social security system.

Since it is mandatory**, your employer has to sign you up for it anyway - you just need to let the HR department of your new employer know with which health insurance provider you are signing up.

If you are having more questions around the social security system in Germany, Contact us at CareME2 with your detailed questions and we will be get back to you.

**If you earn more than 64350 EUR per year or 5362.50 EUR per month, you would be free to opt out of the statutory health insurance and sign up with a

private health insurance company.

Also, if you would be earning less than 451 EUR per month (e.g. for employments under the so called ‘Mini-Job’ framework), none of the social security

insurances would be mandatory.

Disclaimer

CareME2 is not a law firm, hence, it doesn't offer any legal counsel. Rather, the information it provides is purely for general informational purposes. The content on this website is delivered 'as is', without any guarantees of being devoid of errors.